With the current labour shortage in Australia, dental practice's across the country have been struggling to both retain and recruit dental staff. Staff absences due to Covid, Flu and burnout have made even temporary nurses are a scarce resource. This situation has led to staff wages rising dramatically in the sector, with senior and in some cases junior staff able to command rates unimaginable just a few years ago.

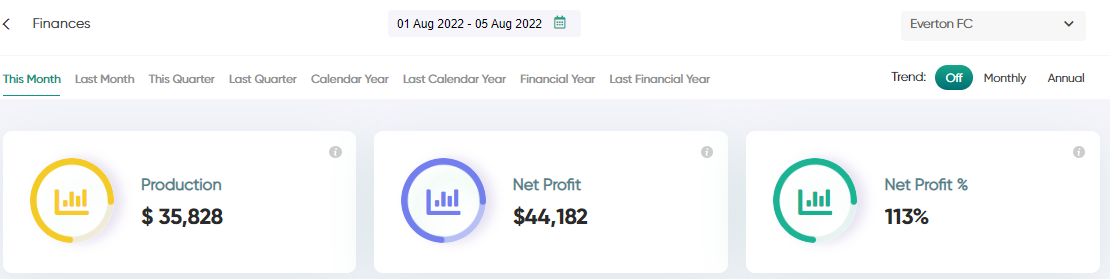

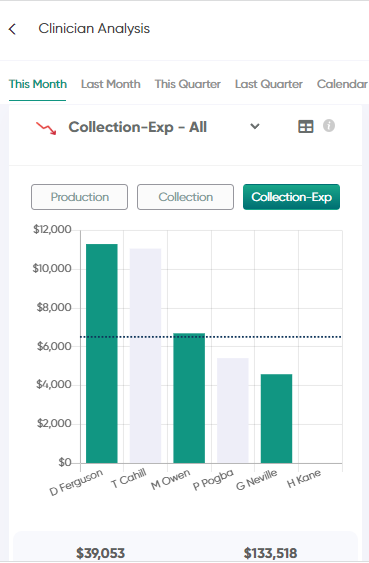

Given the cost-of-living pressures faced by staff, it is more than reasonable that staff should have an increase in their renumeration. But how do we determine by how much? Ideally, we should work within a budget, like any other business. Yet when talking to dental owners, most have no idea what percentage of their revenue goes to staff expenditure. Pay increases seem to be arbitrary in most cases.

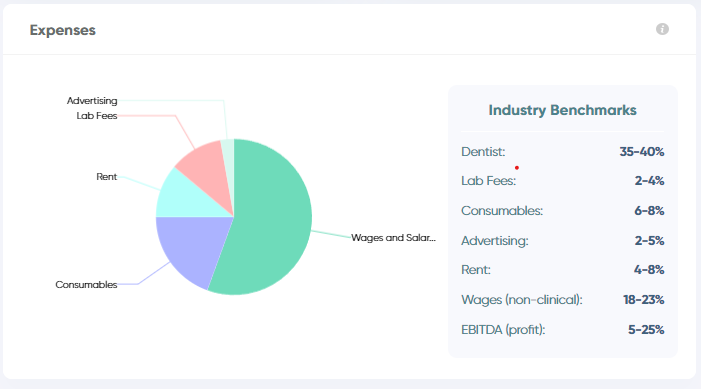

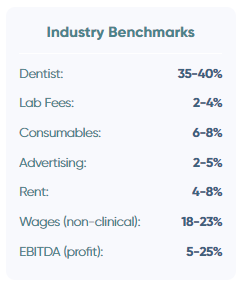

We recommend working towards a budget of 18-23% of collections to determine non-clinical staff wages (including super). Keeping on top of this every quarter, if not month, is imperative. This provides a good framework to assess what pay increases are financially feasible for the practice.

What are the consequences of underpaying staff? Running too lean could lead to staff leaving, a churn cycle of junior staff who are relatively expensive to train. It could also lead to a dramatic reduction in productivity. Likewise, if owners participate in bidding wars to drive up the cost of staff, the impact on the viability of your dental clinic could be threatened. With the economy in turmoil, other costs increasing, and a real threat of a decrease in consumer demand over the next year, emotional decisions could lead to real financial pain.

For example, if we look at a clinic doing $1m in collections, which previously had a staff wages budget of $200,000, a 20% allocation of expenses.

-For this we will assume the clinic is running at 10% profitability ($100,000).

-Lets say the average staff member was on $25ph and this increased to $30- a seemingly small $5 per hour wage increase. This however translates to a 20% increase as a percentage, not including the increase in superannuation that would compound.

-Staff wages would now be $240,000 a year. Profit has now decreased to $60,000 a year, or 6%.

-If we take this a further step, and account for decreased patient demand of say- 5%. Now the clinic is paying $240,000 for staff with an income of $950,000.

-All other things being equal, profit is now only $10,000 a year.

Finally, if we look at the long-term consequences of such a move, we must consider how this could affect the value of the dental clinic as a business. Most dental practice sales are priced based on a multiple of EBITDA- a way of standardising a company's financial performance. A reduction in a clinics operating net income will have a dramatic effect on it's valuation.

The lesson here is that we should ensure any business decision we make is based on real data, and a financial budget. If you don't know what your staff wages expenditure is, you can't make informed decisions when it comes to staff renumeration.

-Jeeve Solutions